Module 6

REVENUE STREAMS

This module aims to provide theoretical and practical information, including examples and exercises, related to the relevance and use of revenue streams in the Business Model Canvas, how these should be applied and how organizations can capitalise on possibilities.

Revenue streams

Introduction

Revenue streams are the total earnings (i.e., income) generated from all products and services by an organization. Revenue streams represent the financial revenue generated from each customer segment to create a profitable (or sustainable) business model. The total earnings (profit) a company generates is calculated with the following equation:

Revenue (gross income) – Costs = Profit (net income)

Purpose

This module aims to provide theoretical and practical information, including examples and exercises, related to the relevance and use of revenue streams in the Business Model Canvas, how these should be applied and how organizations (including start-ups) can capitalise on possibilities.

Revenue streams are a critical component of business models that determine an organization’s profitability and sustainability. They may influence strategy development, business planning and investments.

Revenue streams represent the economic value customers are willing to pay for an organization’s products or services. Although a revenue stream is not a business model, an organization’s choice of revenue stream may influence how other components in the business model canvas are developed.

There are various ways for organizations to generate revenue, and organizations generally have more than one revenue stream. The choice of revenue stream generally depends on the nature of an organization’s product or service and the business model.

Learning Outcomes

After the completion of this module the learner will be able to:

-

- Describe the applications of the revenue streams block and its relation to other blocks;

- Evaluate current revenue streams to assess their strengths and weaknesses;

- Appraise the value of revenue streams and their relevance for organizational strategy;

- Examine and critique current revenue streams in order to improve communication with all customer segments and to improve customer relationships;

- Appraise and evaluate the current revenue streams segment in order to apply creative thinking to design future strategy and to list alternative possibilities and potential innovative revenue streams.

Keywords

-

- Revenue streams

- Transaction based revenue streams

- Recurring revenue streams

- Revenue generating possibilities

- Pricing mechanisms

- Earnings

- Profits

- Sales

- Forecasting revenue

- Strategy

- Innovation

Theoretical background

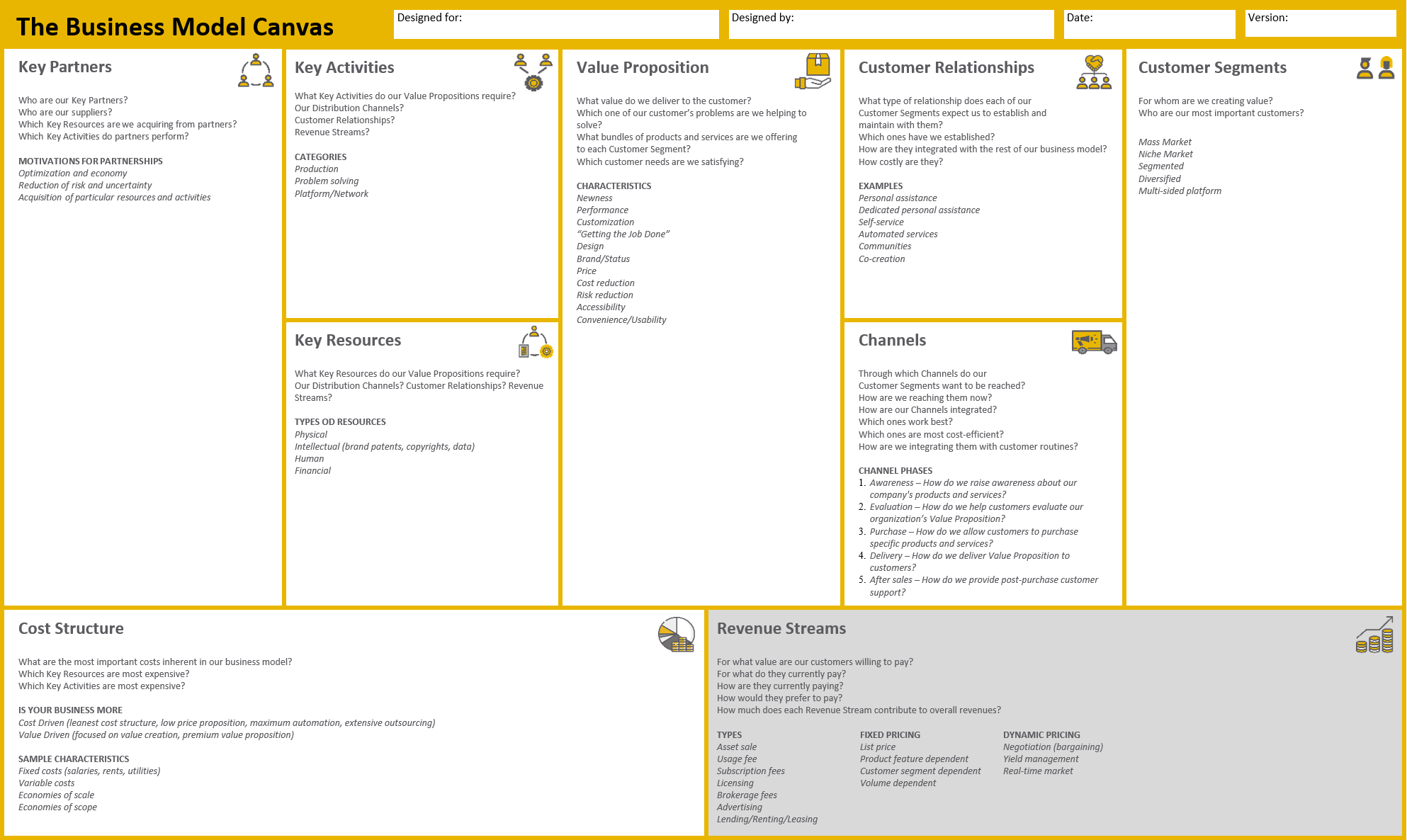

The information related to Revenue Streams fits into the bottom right-hand corner of the Business Model Canvas.

Revenue Streams represent the various sources from which a business earns money through the provision of goods or services. The types of revenue that an organization takes into consideration depends on the types of activities conducted.

Key elements to take into consideration include:

-

- The nature of the product or service and the business model (including the value proposition and the cost structure) which influence how the product is priced;

- The pricing strategies which include: Economy, Penetration, Skimming and Premium.

A revenue stream generally comprises either recurring revenue, transaction-based revenue, project revenue, or service revenue. In government, the term ‘revenue stream’ often refers to different types of taxes.

Revenue Models, Revenue Streams and Business Models

A revenue stream is easily confused with a revenue model which, in turn, is often confused with a business model.

Definition of a revenue stream:

A revenue stream is a distinct source of income that comes about from either recurring revenue, transaction-based or service revenue. A business can have a single source of revenue or multiple sources, depending on its business model.

Definition of a revenue model:

A revenue model is a framework for generating revenue. It comprises the strategy for how a business generates income from either single or multiple revenue streams. As a strategy, it involves consideration of what value to offer, how to price the value, and who pays for the value.

Types of revenue streams:

-

- Transaction-based revenues: customers make a one-time payment for a product or service.

- Recurring revenues: continuous payments for the delivery of products or services (e.g., subscriptions, leases, rentals, etc.).

Types of revenue:

-

- Operating revenue: the amount earned from the organization’s core business operations, e.g., sale of goods or services;

- Non-operating revenue: the amount earned from the organization’s other activities, this may include dividend revenue and interest revenue.

Generating Revenue

There are numerous ways to generate revenue from products and services.

Many markets have been disrupted by changes to revenue models, particularly in today’s digital economy.

For example, by going digital, the music industry was transformed, shifting from tangible CDs and albums (transaction-based revenue) to subscription-based music streaming services, such as Spotify and Apple Music (recurring revenue).

Revenue streams and pricing mechanisms

Each of an organization’s revenue streams may have its individual pricing mechanism. There are two types of pricing mechanisms:

-

- Fixed pricing: This is the fixed price stipulated by the manufacturer of a product or the provider of a service which remains uniform and stable. A fixed price may be customer segment dependent (taking the traits of the target customer segment into account), product feature dependent (priced according to the number of features available), or volume dependent (priced depending on the quantity purchased, where the higher the quantity, the lower the price).

- Dynamic pricing: This is when the price is variable and changes depending on market conditions.

Dynamic pricing may involve:

-

- Bargaining: the price is negotiated between two or more parties, with the outcome of the negotiation dependent on the bargaining skills of those involved and on power dynamics.

- Auctioning: the final price depends on the customers’ perception of the value of the product or service. This involves customers bidding (sharing what they are willing to pay) for a product or service, with the highest bid successfully obtaining the product or service.

- Yield Management: the price (which is variable) depends on availability of the product or service at the time of the purchase. Organizations may use customer intelligence to create revenue. Airlines and hotels generally adopt this revenue model.

- Real time market: the price fluctuates, either due to supply and demand or due to influence from the competition. The price may drop if there is a surplus of supply, or rise if there is a surplus of demand. Scarcity of a product or service (e.g., fresh vegetables which depend on seasonality) would imply an increase in price. If the competition offers similar (or identical) products or services at a lower or higher price, this too would influence the price.

Earnings generated from pricing mechanisms

A revenue stream incorporates the earnings a business generates from certain pricing mechanisms and channels. It may take the form of:

-

- Transaction-based revenue: Proceeds from sales of goods, generally one-off payments.

- Service revenue: Proceeds from providing service to customers, generally calculated based on time (e.g., the number of hours of consulting services provided).

- Project revenue: Earned through one-time projects with existing or new customers.

- Recurring revenue: Proceeds from ongoing payments for continuing services or after-sale services to customers. The recurring revenue model is often used because it is predictable and it generally ensures an ongoing revenue stream (e.g., subscription fees; renting, leasing, or lending assets; licensing content to third parties; brokerage fees; advertising fees).

Types of Revenue Streams

-

- Sale of goods or service fees: this is generally the core operating revenue account for most organizations. It is probably the most traditional and well-known revenue stream, where a seller sells a product or service to a purchaser.

- Service subscriptions: this involves recurring transactions (monthly, annually, etc.) and includes web hosting services, internet service providers and phone network services. Different possibilities may be offered to different customer segments, depending on how widespread the service uptake is.

- Advertising: the communication of a product or service to an audience of potential customers.

- Agents and Brokers: intermediaries who receive a commission (generally a percentage fee) for their services.

- Asset Sale: this generally involves a one-off transaction where an asset is sold.

- Business Service: this may incorporate various revenue types (e.g., designing and building a website for an organization initially involve a one-off transaction which may later move towards a subscription model where maintenance and updates are concerned).

- Club Goods: this involves an entrance fee (e.g., cinemas, museums, theme parks).

- Consulting: consulting organizations generally operate on a retainer basis. Some may operate on a specific project basis. The retainer may specify an explicit maximum number of working hours.

- Content subscriptions: this generally allows for access to online media, such as newspapers, podcasts, TV streaming services (such as Netflix), music services (Spotify) and other media portals.

- Consumer services: these may range from restaurants to home repair / maintenance services, technical services, beauty salons and hairdressers.

- Education and Training: this may be directed towards either individuals or organizations. It may be delivered in various ways, such as face-to-face, online or via blended learning (a mix of both).

- Experiences: this capitalises on people’s thirst for new experiences. It includes travel, abseiling, parachuting, kite surfing, real-life war gaming, treasure hunts, escape rooms, etc.

- Metered services: this involves calculating consumption of a service (e.g., water, electricity or gas).

- Interest: the interest earned on investments, which is usually classified as non-operating revenue.

- Rent: earned from the renting out of buildings or equipment, this is considered to be non-operating revenue.

- Dividends: earned from holding bonds or stocks of other organizations, also considered as non-operating revenue.

- Licensing: this involves the licensing of intellectual property.

- Franchising: this involves the sale of the rights to the business logo, name and model to third party retail outlets owned by independent operators known as ‘franchisees’. A contract is generally drawn up which stipulates the regular payment of royalties from the franchisee to the franchisor. McDonalds, Subway and UPS are well-known examples of franchise business models.

- Media: Production organizations that make movies, documentaries, TV series and podcasts may sell the media they produce to other organizations.

- Broadcasting rights: this also involves the sale of media rights. It is the largest source of revenue for most sports organizations and other mega-events (e.g., concerts or other large-scale music events).

Why does understanding revenue streams matter?

-

- Revenue is a Key Performance Indicator (KPI) for all organizations:

A Key Performance Indicator (KPI) is a measure that aligns to the overall organizational strategy. Financial KPIs link to revenue and profits, but they may also include cash flow and liquidity. Revenue is a key measure for all stakeholders, including start-ups and large corporations. - Performance prediction differs between different revenue streams:

Organizations ought to be able to predict the amount of sales that will be generated in the future. Investors and shareholders have a vested interest in financial forecasts, which allow for a better understanding of the organization’s future prospects. Recurring revenue is more predictable than transaction-based revenue, as it is generated by a stable customer base. Transaction-based revenue may fluctuate, depending on customer demand and seasonality. - Different revenue models require different forecasting methods:

Financial experts apply different forecasting models to obtain future predictions, depending on the type of revenue model adopted. Forecasting models may be more uniform and reliable when they deal with recurring revenue streams.

- Revenue is a Key Performance Indicator (KPI) for all organizations:

How is revenue calculated?

Calculating revenue streams may comprise a simple or complicated process. Some organizations may offer promotional codes, often with a different value. A product that has an original price of €100 could be discounted down by 10% – €90, 20% – €80, etc. In such cases, the total revenue is the total of all the sales at each price point.

For product sales, revenue is calculated by taking the average price at which goods are sold and multiplying it by the total number of products sold. For service providers, it is calculated as the value of all service contracts, or by the number of customers multiplied by the average price of services.

Examples and Good practice

Spotify Case Study

The business model for Spotify (founded in Sweden in 2006 and launched in 2008) is based on their digital platform which offers music streaming and which connects artists with fans. Spotify has acted as a huge disruption for business related to the distribution of music. Today, Spotify is one of the leading global music streaming platforms. Apple iTunes is Spotify’s main competitor.

In its early days, Spotify was an invite-only platform, which meant that one needed an invitation to get access. Open use was not available until it launched in the UK in 2009. Due to high demand, Spotify reverted to invite-only later that year. They also used the invite-only model for their launch in the USA in 2011. This implies that Spotify recognised the value of word-of-mouth recommendations.

Spotify has two main revenue streams: Premium Accounts (which adopt a subscription business model) and Advertising (for ‘freemium’ users). With hundreds of millions of users and a world-wide reach, Spotify obtains most of its revenue (Euro.1,731 billion in Q3 in 2019) from Premium Accounts. Advertising supported revenue (Euro.0.71 billion in Q3 in 2019) is obtained from users who have a basic (as opposed to a Premium) account, as the music which they stream is interspersed with adverts. Ad-supported accounts offer a limited number of listening hours per month.

Gillette Case Study

The Gillette ‘Razor and Blade’ Business Model is one example of a Business Model Pattern which has spread across numerous products and industries. It involves an innovative way of modifying their revenue stream and value proposition.

Gillette charged basic rates for its razors, while capitalizing on blades (Gassmann et al., 2013). Examples of other industries that adopted this model include printers (which are sold relatively inexpensively), and their respective cartridges, which enable organizations to sustain their income and, consequently, their profitability.

Coffee machines that make use of disposable coffee pods are another example of this model (Gassmann et al., 2013).

Rolls Royce Case Study

Rolls Royce, originally established in 1884, initially specialized in manufacturing engines, making the company a product-based business. Through its initial business model, Rolls Royce manufactured and sold engines to, for example, aircraft manufacturers, with the company generating revenue from one-off large sales.

To generate a more sustainable revenue stream with more predictable and stable flows of income, Rolls Royce launched ‘power-by-the-hour’, where the organization transitioned from selling engines to ‘leasing’ engines based on airline use-hours. Through this business model innovation, airlines only pay for the operating hours of the engine, benefitting from reduced capital expenditure.

Given that Rolls Royce ‘leases’ its engines, maintenance and repair costs are the responsibility of Rolls Royce, making airline engines more affordable to different customer segments, such as low-cost carriers. Through this revenue stream innovation, Rolls Royce was able to penetrate a new target market, while simultaneously securing long-term revenue through leasing engines as opposed to selling them. (Click here for link to case study)

Digital Technology: Revenue stream testing

Digital technologies allow for the possibility of testing new products and services to assess which version of a product or service is most profitable, or assess whether potential customers understand the organization’s value proposition, and who may, subsequently, be willing to effect a purchase. (See for example: https://win.gg/news/3661/riot-is-testing-different-league-of-legends-shops-in-lol-client).

Some digital platforms require the generation of a substantial user base before revenue is generated, e.g., Facebook did not generate revenue for some years, until it later introduced advertising.

On other digital platforms, the revenue source may not be obvious, e.g., use of Google’s search engine platform is free. However, Google sells the search data and the ability to advertise as a method of generating revenue. Google’s main source of revenue is advertising. This includes the algorithm used for online searches which incorporates suggested pages from advertisers, together with other relevant results. Google also generates revenue from its cloud related services, such as Google Cloud.

Start-ups and organizations that offer new products or services via a digital platform are dependent on customer engagement which may include signing up for promotional emails or the regular use of and contribution to particular social media platforms, discussion boards or other web platforms.

Engagement on these platforms and understanding the value proposition of an organization are essential before purchase of goods or services is ensured. Organizations that use digital platforms require a strategy to successfully populate these platforms and to motivate regular customer engagement which will lead to sales and customer retention.

Strategy and Innovation

Each segment in the business model canvas provides a picture of the current situation related to that segment (for established organizations) and a model of what the revenue streams (in this case) are expected to be for start-ups.

Key questions that arise are:

-

- What comes next?

- Which specific business objectives and activities should be targeted in order to add additional revenue streams or to innovate current revenue streams to expand the organization’s market share?

Innovation

The revenue streams segment in a business model canvas may act as a trigger for innovation.

These questions could be considered:

-

- If the elements listed under revenue streams were to be simplified, would this result in increased efficiency, profitability and increased customer value?

- What if incremental innovation (minor changes that are original and effective) were to be considered?

- Could radical innovation (major changes that incorporate disruption or a paradigm shift) be possible if tools to create radically new innovations were to be implemented? What about integrating new technology into the organization’s business model? What about developing strategic collaboration with other organizations to reduce cost and increase profitability?

Simplicity

Take each of the listed revenue streams in turn and evaluate their value.

-

- Is it possible to simplify any of the listed revenue streams?

Incremental innovation: SCAMPER

The SCAMPER tool may be used on each revenue stream (more details and examples are found on the following slides). SCAMPER stands for:

-

- S: Substitute

- C: Combine

- A: Adapt

- M: Modify (Magnify, Minify)

- P: Put to another use

- E: Eliminate

- R: Reverse

S: Substitute: Is it possible to substitute any of the revenue streams? This may be done through an assessment of the revenue streams on a business model canvas which is generated for the competition. Can any of the revenue streams which the competition utilises replace any of the current revenue streams? An example of the use of ‘Substitute’ involves consideration of the ‘No Frills’ revenue stream model, where income is generated from the sale of additional services (such as servicing of devices or supply of ancillary parts). The ‘Subscription’ revenue stream could then be applied to, for example, no-frills airlines, as a result of using ‘Substitute’. This would be applied to regular users of no-frills airlines who develop loyalty to one airline rather than others, due to reduced costs. Additional examples include expensive medical devices which are leased (rather than sold) to large hospitals.

C: Combine: Is it possible to combine two or more of the current revenue streams? ATM cash machines are an example of ‘Combine’ as they provide users with the possibility of withdrawing cash, depositing cash or cheques and providing information related to account balances. ‘Combine’ could be applied to Supermarkets and Restaurants which could adopt the Freemium revenue model (offering a basic amount of free food, for example, to customers whose regular spending exceeds a certain limit), or Subscription, which would allow for privileges such as a fast checkout process (time is valuable to most professionals today).

A: Adapt: How could a successful and profitable revenue stream be adapted for another customer segment? An example of ‘Adapt’ involves the revenue model for print and online media organizations, which could incorporate crowdsourcing and customer designed content into their print and online production. Some media organizations already utilize customer created content, but this could be expanded to include a section where readers provide in-depth opinion pieces or, alternatively, ideas as to how the format and design of the online portal could be made more attractive. This could lead towards increased personal customization of a variety of online platforms.

M: Modify (also ‘Magnify’ or ‘Minify’): Could an evaluation of each of the revenue streams as designed for each customer segment be modified (magnified or minified) in any way to make it more successful and profitable? One example is the pay-per-use model which has been adopted by some motor insurance companies to enable customers to pay insurance premiums that are a better reflection of the distances they travel and their driving habits, rather than the traditional annual fee.

P: Put to another use: Looking at the revenue streams for the competition (on their potential business model canvas), could any of these be put to another use in our organization’s business model canvas? Restaurant and hotel facilities could be put to another use, particularly during off-peak seasons when occupancy rates are low. The other uses need not generate revenue directly – they could address social causes through CSR (Corporate Social Responsibility) activities such as free meals for the elderly at particular times. This could generate positive publicity for the hotel and, in turn, attract socially-conscious customers.

E: Eliminate: Could any of the current revenue streams be eliminated due to the resources committed to that revenue stream or due to lack of profitability? This could apply to the Freemium revenue stream, for example, with products that are sold for a low price, including sweets, tissues, etc. If these were offered to customers without any cost, the producers could still generate a profit by including advertising on the packaging. This would compensate for the expenses involved and eliminate the need for small amounts of money to be paid by the customer.

R: Reverse: On examination of each of the revenue streams, could any of them be reversed (e.g., reversing a payment revenue stream and offering it for free)? The Freemium example (See ‘Eliminate’) also applies here. Reverse could be applied to the time when customers are expected to pay for products and services. For example, hotels generally require payment in advance, at check-in or, at the latest, at check-out. Hotels could offer the option to pay on credit (e.g., up to one month later), perhaps with an extra ‘late payment’ fee for added revenue. This could be attractive to shopper-travellers, as it might give them the possibility to overspend on a shopping spree without worrying about immediate settlement of their hotel bill. For such a system to function effectively and to ensure the late payment is effected, the hotels would require some form of security, such as the customer’s credit card and other personal details.

Radical innovation

Various idea generation tools could be used to generate new revenue streams or instigate radical innovation. One useful tool is ‘Random Input’, see, for example:

http://members.optusnet.com.au/charles57/Creative/Techniques/random.htm

https://www.designmethodsfinder.com/methods/random-input

https://creativiteach.me/creative-thinking-strategies/random-input/

Innovative revenue streams could be designed in this manner. This may involve focussing on the value proposition and applying the random input tool here, with the aim of generating new ideas which would subsequently be tested.

References and External Links

https://www.mindtools.com/pages/article/newCT_02.htm

General Reading

-

- Gassmann, O., K. Frankenberger and M. Csik, 2013. The St. Gallen Business Model Navigator. Working Paper, University of St. Gallen, Switzerland.

- https://strategyzer.uservoice.com/knowledgebase/articles/1194385-how-do-i-use-the-revenue-streams-building-block-of

- https://www.thegeniusworks.com/wp-content/uploads/2017/06/St-Gallen-Business-Model-Innovation-Paper.pdf

Case studies

UBER: https://www.garyfox.co/uber-business-model/

Different revenue stream case studies: https://www.garyfox.co/business-models/

Downloadable tools

https://www.boardofinnovation.com/tools/

Video: Revenue Streams Crash Course

Copyright @2021 – businessmodels.eu