Module 10

COST STRUCTURE

The purpose of the Cost Structure Module is to support managers to identify the two main categories of cost and to calculate total costs.

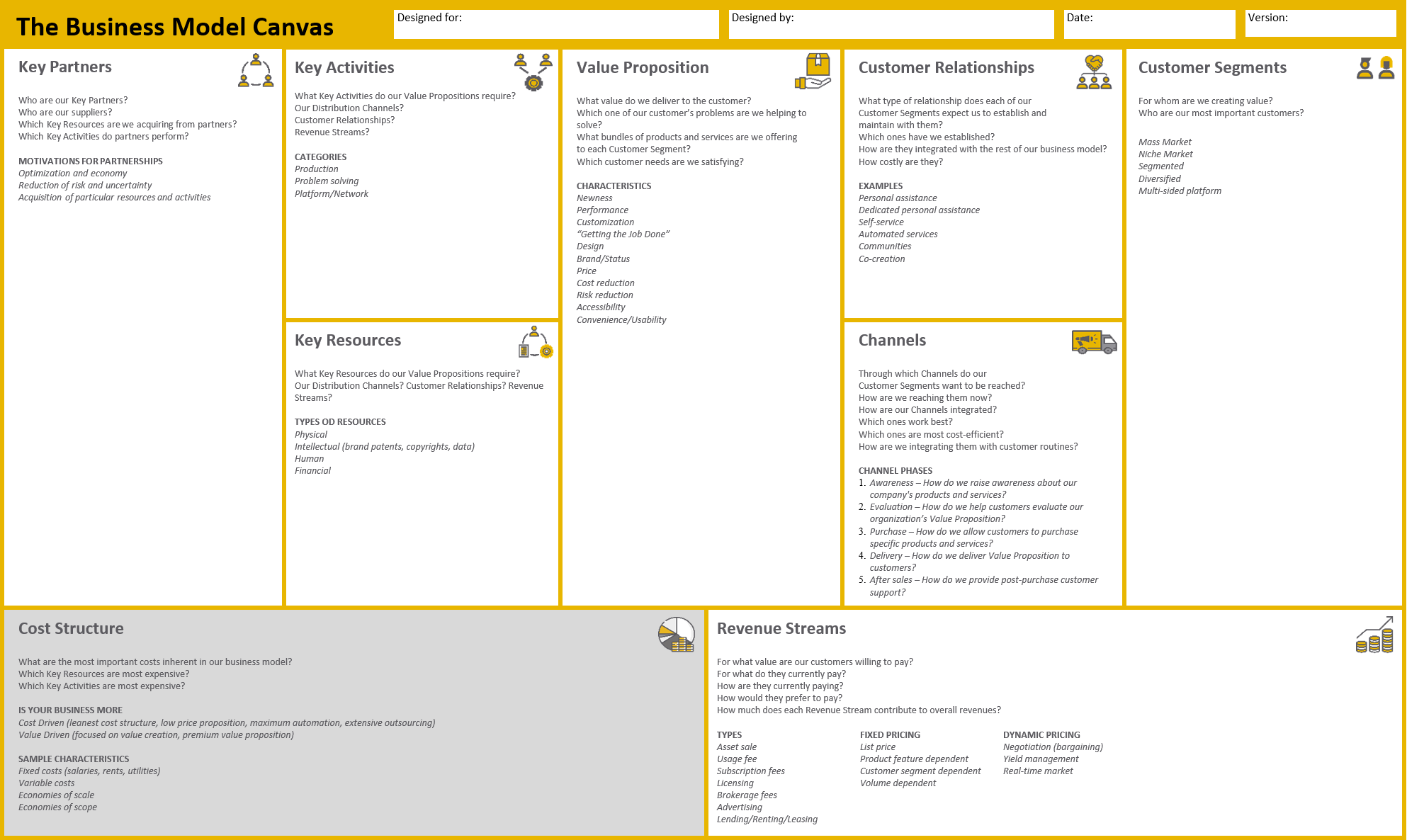

Cost structure

Introduction

The Cost Structure is one of the most important indicators characterising the costs in the organisation. The cost structure includes all costs and expenses that the company will incur when introducing a business model.

Purpose

The purpose of the Cost Structure Module is to support managers to identify the two main categories of cost and to calculate total costs.

Learning Outcomes

After the completion of this module the learner will be able to:

-

- differentiate between fixed costs and variable costs;

- define and give examples of variable costs;

- define and give examples of fixed costs;

- calculate variable costs;

- calculate fixed costs;

- optimise costs in the company.

Keywords

-

- cost structure

- variable costs

- fixed costs

- optimisation

- business model

Theoretical background

Categories of cost structure

There are two main categories of the cost structure:

-

- Value-driven cost structures, which focus on creating more value in the product itself, not necessarily producing it at the lowest possible cost. Examples include luxury fashion brands, jewellery brands or luxury hotels.

- Cost-based cost structures, which focus on minimising the cost of a product or service as much as possible. Examples include low-cost airlines or widely available furniture stores that allow you to assemble furniture at home.

Costs in the company – division

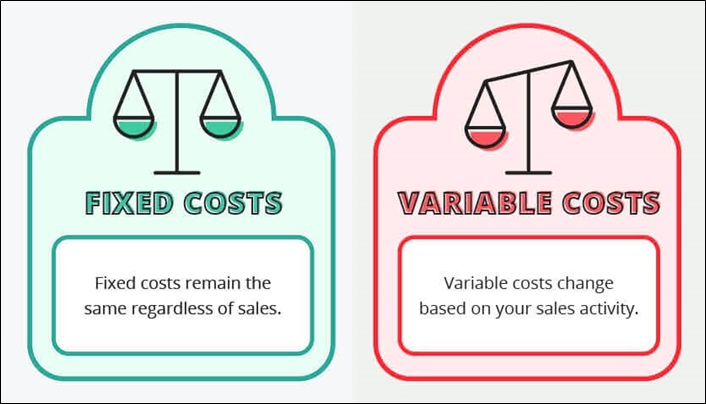

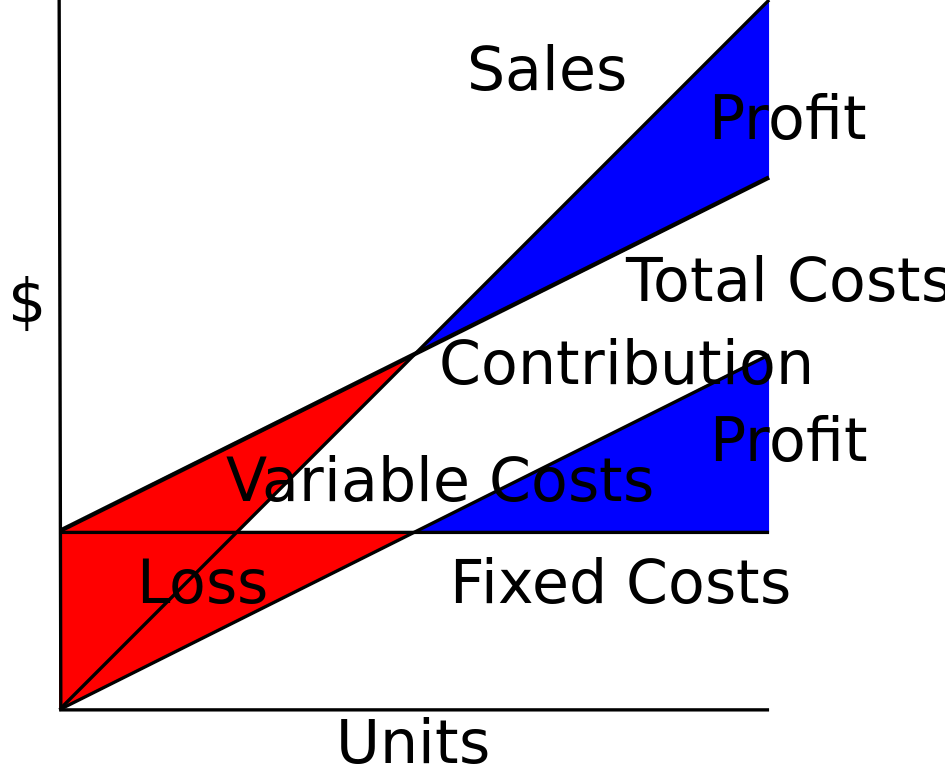

Source: https://diffzi.com/fixed-cost-vs-variable-cost/

|

|

Together, they represent the total costs (TC) incurred by the enterprise. Hence, variable costs include all types of costs in the enterprise that are not included in the fixed costs.

Information on variable and fixed costs is used for short-term decision making and variable cost accounting.

Fixed costs – definition

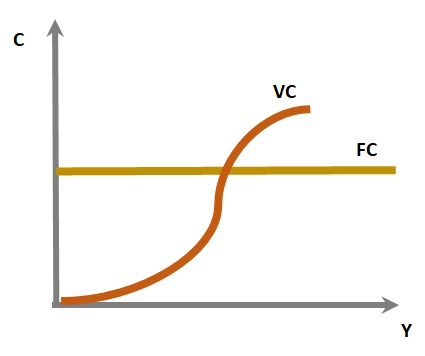

| Fixed costs do not change with a change in production volume. This means that reducing production does not change fixed costs.

Fixed costs remain the same over a long period of time, but this does not mean that their value is always the same. The costs depend on macroeconomic conditions and therefore the costs are subject to change, but not due to the level of activity. Source: https://commons.wikimedia.org/wiki/File:CVP-TC-FC-VC.svg |

|

Fixed costs – types

Fixed costs can be divided into:

-

- absolute fixed costs – they are not subject to any changes when the production volume changes (e.g., depreciation write-offs when fixed assets are settled using the straight-line method);

- incremental fixed costs – their value does not change only in the size range, after which they increase, and where they stabilize again (e.g., renting a production hall, after exceeding a certain production value it is necessary to rent an additional hall).

The examples of fixed costs can be the following:

Source: https://commons.wikimedia.org/wiki/File:CVP-TC-FC-VC-Sales-Contrib-VC-PL-compat.svg |

|

Fixed costs – basic rule

In distinguishing whether the cost is fixed or variable, consideration should be given not to the period of time, but to whether the cost is affected by the production volume.

Fixed costs – formula

When dividing the fixed costs by the production volume, we get the average fixed cost:

AFV= FC/Q

AFC – average fixed cost

FC- fixed cost

Q – production volume

https://poradnikprzedsiebiorcy.pl/-koszty-stale-i-zmienne-klasyfikacja-kosztow-w-dzialalnosci

Variable Costs – definition

Variable costs are costs that the entrepreneur incurs for activities related directly to the current production level.

It is commonly assumed that variable costs change with changes in production volume.

In the definitions of variable costs, “production” should be understood broadly as “activity volume”, so variable costs are costs that change with the size of the company’s business volume.

They grow with increasing volume:

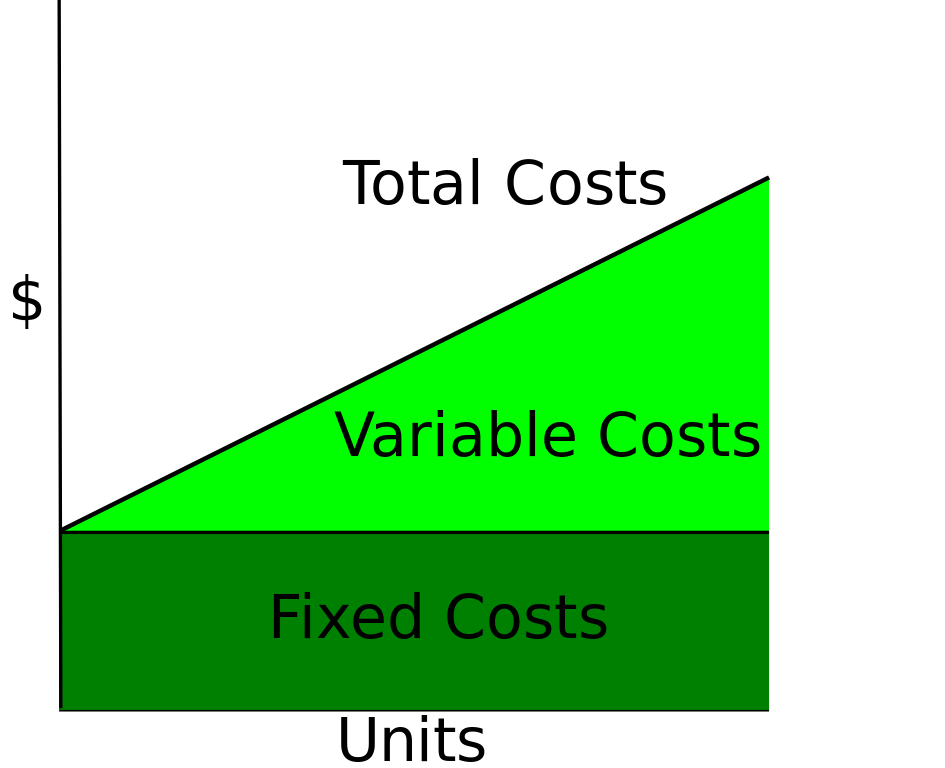

TC = FC + VC

TC –Total Cost, FC –Fixed Costs, VC – Variable Costs.

Variable Costs

|

The variable costs include, among others:

With little production, variable costs soar. However, when increasing production, these costs stabilize and increase slightly along with a further increase in production (introduction of production specialisation). |

|

By changing as the volume of activity changes, variable costs may respond to these changes in different ways. Due to the nature of the reaction, variable costs are divided into:

Variable costs are included in profit forecasts and when calculating the break-even point (BEP) for a company or project (methods for calculating the costs are presented in the Financial part).

|

|

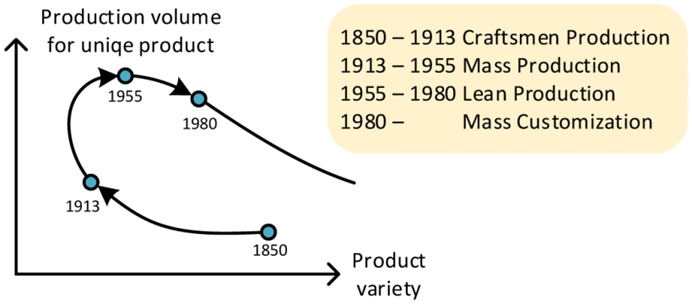

Cost Optimisation – Changing Fixed Costs into Variable Costs

Currently, in the era of a pandemic and financial crisis, changes in customer behaviour, increasing price competition and more and more difficulties in obtaining financing for operations, control and optimisation of the cost structure are of particular importance.

The following should be done:

-

- Ensure that the information obtained is reliable;

- define unequivocally the problems of the enterprise;

- analyse the key elements of the business model and how they can be changed;

- define the main cost drivers and their conditions, identify costs that can be reduced;

- apply benchmarking and other methods to assess cost-effectiveness;

- change from fixed to variable costs;

- simplify the business model;

- implement budgeting and monitoring tools.

Examples and Good practice

Fixed costs – example

Entrepreneur ABC wants to produce cups, and has a fixed cost of $10,000 per month. If the company does not make any cups, it would still have to pay $10,000 to rent the machine. If it produces a million cups, its fixed cost is still the same. Variable costs go up to $ 2 million.

Response: The more fixed costs a company has, the more profit it must make in order to be able to break even, so it has to work to produce and promote its own products. This is because these costs change and occur.

References and External Links

-

- Fixed and variable costs – classification of operating costs (PL: Koszty stałe i zmienne – klasyfikacja kosztów w działalności)

- https://poradnikprzedsiebiorcy.pl/-koszty-stale-i-zmienne-klasyfikacja-kosztow-w-dzialalnosci

[accessed 31.08.2020] - Samuelson A.A., Nordhaus W.D., Ekonomia 2, PWN, Warszawa, 2007

- Sloman J., Podstawy ekonomii, PWE, Warszawa, 2001

- Czubakowska K. (2015). Rachunek kosztów i wyników, Polskie Wydawnictwo Ekonomiczne, Warszawa

- Nowak E. (2011). Rachunek kosztów w jednostkach gospodarczych, Podejście sprawozdawcze i zarządcze, Ekspert, Wrocław

Copyright @2021 – businessmodels.eu